As someone who has been in the check printing business for years, I’ve seen firsthand how important it is to understand the parts of a check and check security features. It’s not just about writing and receiving payments; it’s about security, clarity, and avoiding financial mishaps. So, let’s break it down, shall we?

1. The Front of the Check

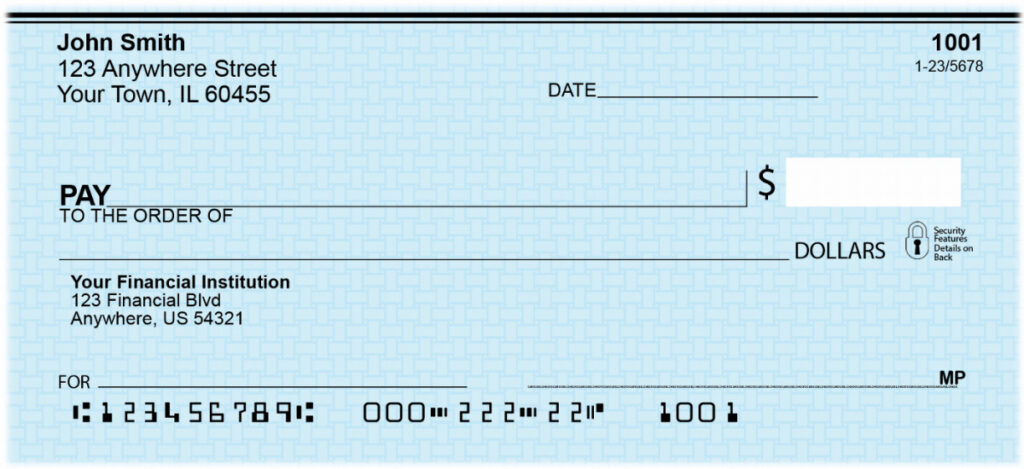

This is where most of the action happens. Every part here is crucial for the check to be valid and secure.

Payor’s Information

At the top left, you’ll usually find the payor’s name and address. This isn’t just for show – it’s a key part of the check’s identity. I remember a client who once received a check without this information; it was a nightmare to process!

Date Line

Next comes the date line. Always ensure it’s filled out correctly. The date isn’t just a formality; it legally dictates when the check can be cashed or deposited.

Payee Line

This is where you write who the check is for. A small typo here can cause big headaches. I once had a client who accidentally wrote “Public Library” instead of “Public Utilities” – you can imagine the confusion that caused!

Numeric and Written Amount Fields

Here’s where you’ll see two fields for the amount – one in numerals and one spelled out. If there’s a discrepancy between these two, banks typically go by the written amount. It’s a double-check (pun intended) against fraud and errors.

Memo Line

Though optional, the memo line can be a lifesaver for keeping track of why the check was written. I always advise my business clients to use this space diligently – it’s great for record-keeping.

2. Security Features

Checks are more than just paper; they’re a bundle of security features.

Watermarks

Watermarks are a subtle yet effective security feature in check paper. These images or patterns, embedded into the paper during manufacturing, are typically invisible under normal lighting but become visible when held up to light. Watermarks are difficult to replicate, providing a reliable way to authenticate a check and deter counterfeiting. This feature adds an extra layer of security by ensuring the originality and legitimacy of the check, protecting against fraud and unauthorized reproductions.

Void Pantograph

The void pantograph is a crucial check security feature designed to prevent unauthorized copying and counterfeiting. Embedded in a check’s background, it’s usually invisible but becomes prominently visible, often displaying “VOID,” when photocopied or scanned. This feature deters counterfeiters, as any copies clearly indicate they are not the original. It’s a standard security measure for legal compliance and is often used alongside other features like microprinting and watermarks for enhanced protection. While effective against basic duplication attempts, it’s part of a broader security strategy to counteract sophisticated forgery methods, evolving continually to stay ahead of advancements in copying technology.

UV Fibers

UV fibers in check paper are a discreet but effective security feature. These tiny fibers are embedded within the paper and are invisible under normal light. However, when exposed to ultraviolet (UV) light, they fluoresce, verifying the check’s authenticity. This feature is difficult to replicate, making it an excellent deterrent against counterfeiting and fraud. UV fibers are used in combination with other security elements to ensure the integrity and security of checks in financial transactions.

Chemical reactive paper

Chemical reactive paper is a security feature in checks designed to thwart tampering. The paper reacts visibly to common chemicals used in check washing (altering the written amounts or payee names). If tampered with, the paper displays stains or discoloration, signaling an attempt to alter the check. This feature helps prevent fraud by making it difficult to modify the check’s original information without detection, enhancing the overall security and integrity of the financial document.

Microprinting

Microprinting is a security feature in checks involving tiny, almost invisible text, typically found in signature lines, borders, or the check’s background. This text appears as a solid line to the naked eye but reveals legible words or patterns under magnification. Microprinting is extremely difficult to replicate accurately, especially with standard photocopying or scanning equipment, making it a powerful deterrent against forgery and counterfeiting. Its presence helps validate the check’s authenticity and safeguards against fraudulent alterations.

Signature Line

The signature is your final seal of approval. It’s legally binding and personalizes the security of the check. I’ve seen checks returned because the signature didn’t match the records – it’s that important. Look closely and you will see that the signature line is microprinting and easily readable with a loupe.

Secure Barcode

Enter the world of Secure Barcode – a game changer in check fraud prevention. This technology embeds encrypted data into the check, making it nearly impossible to replicate or alter without detection.

3. The Back of the Check

Though less glamorous, the back of the check is vital for processing.

Endorsement Area

This is where the recipient signs the check to deposit or cash it. Remember, a check isn’t valid until it’s endorsed.

Security Screen and Warning Box

These features are less known but act as silent guardians. They usually contain phrases like “Original Document” and change appearance when photocopied, preventing duplication.

Conclusion

Understanding the anatomy of a check is key to financial security and effective transaction management. Whether you’re writing a check for a utility bill or handling a business transaction, knowing these parts and their functions keeps you one step ahead in the financial game.

Expert’s Tips

- Always double-check the payee name and the amount fields.

- Be cautious with post-dated checks; they can be cashed earlier than intended.

- Regularly review your checks for any signs of tampering or unusual activity.

- Understand check security features and how they keep you safe.

Remember, a check is more than just a piece of paper; it’s a tool that carries both financial value and information. Handle it with care, and it will serve you well.