Secure Barcode

Secure Barcode offers two distinct levels of check security services to cater to diverse business needs. Level I Service is tailored for manually written checks, ensuring authenticity with key imprinted data like check number, account/routing number, and payor details, alongside automatic alerts for any altered information. Level II Service elevates security for laser printed checks, adding tamper-proof fonts and an expanded secure barcode that includes payee details, transaction amount, date, and precise data positioning. Both services integrate seamlessly with your banking practices, combining traditional methods with advanced security technologies for ultimate fraud prevention.

Secure Barcode offers an innovative solution for financial institutions to combat check fraud. It involves printing encrypted data matrix barcodes on the face checks, providing a more secure and efficient method to prevent and detect fraud.

This technology is especially relevant given the high incidence of check fraud in the U.S., where traditional fraud detection methods like Positive Pay are becoming less effective. Secure Barcode’s approach is designed to protect against various common fraud techniques, such as chemical washing, toner lift-off, photocopying, and theft of account information. It offers enhanced security for both manually written and laser-printed checks by embedding key information like account details, payee information, and check amounts within the barcode.

This service, which has been in use for over 15 years by a partnering company, presents a cost-effective, automated, and highly accurate fraud prevention tool for financial institutions, significantly lowering the risk of check fraud and related losses.

Level I: Manually Written Checks

- Authenticity Validation: Our system rigorously verifies the authenticity of manually written checks issued by the bank, ensuring each transaction’s integrity.

- Embedded Secure Barcode: Each check is embedded with a secure barcode containing crucial imprinted data:

- Check Number: To uniquely identify each transaction.

- Account/Routing Number: Ensuring accurate and secure banking information.

- Payor Details: For clear and verifiable identification of the issuer.

- Automatic Alteration Detection: Our advanced software is designed to instantly alert users to any altered information on the check, enhancing security against fraud.

- Authorized Check Printing: Checks are exclusively provided by authorized printers, guaranteeing the highest quality and adherence to security standards.

Choose Level I Service for robust protection on all manually written checks, combining traditional banking practices with cutting-edge security technology.

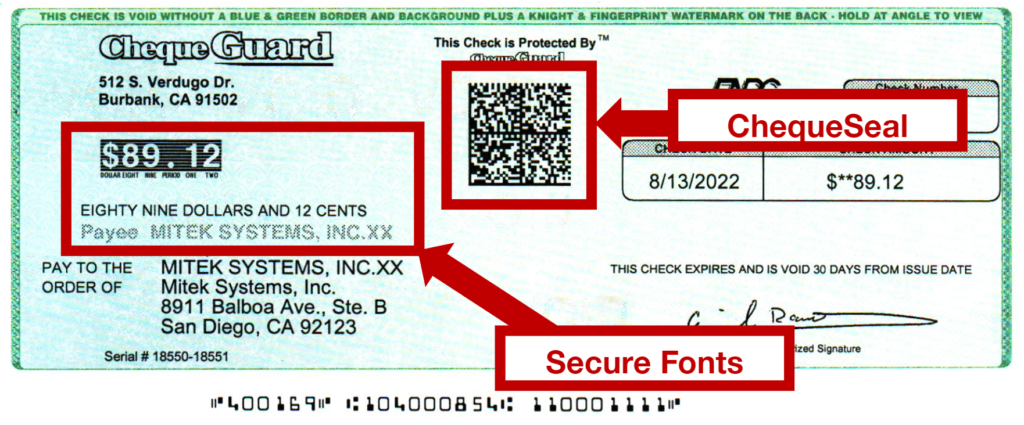

Level II Service: Laser Printed Checks

- Enhanced Security Features: Building upon the foundation of our Level I service, Level II introduces additional safeguards for laser printed checks:

- Tamper-Proof Fonts: We employ specialized fonts for payment amounts and payee details, adding an extra layer of security against alteration.

- Expanded Secure Barcode: The barcode is larger and includes comprehensive information for heightened security:

- Payee Details: To precisely identify the recipient of the funds.

- Amount: Ensuring the accuracy of the transaction value.

- Date: Recording the issuance date for better tracking and validation.

- Data Positioning: Capturing the exact layout of all data on the check, further safeguarding against unauthorized modifications.

- Advanced Printing Technology: Checks are produced using sophisticated customer software and a provided print driver, ensuring seamless integration with your existing systems.

Opt for our Level II Service for ultimate protection on laser printed checks, integrating the latest in security technology with your business’s operational needs.

It’s crucial to highlight that while adding Secure Barcodes to checks will absolutely strengthen security, no solution is perfect. To develop a strong defense against check fraud, it should be supplemented with additional security measures such as watermarking, check patterns, and client education on identifying authentic checks. To defend oneself from developing fraudulent practices, financial institutions and people must keep aware and current with the latest technological advances in security.

Experience the Future of Check Security – Get Started with Secure Barcode

Step into the future of banking with our next-gen encrypted check solution.